At a glance

Insurance agency portals are becoming essential tools for staying competitive in a digital-first landscape. This blog explores why they matter and how the right platform can unlock hidden productivity gains across your team. You’ll discover the core features that separate basic file-sharing systems from true client engagement platforms, along with real-world examples of agencies improving service and efficiency. Finally, we’ll look at how Moxo brings it all together through workflow-driven automation, secure collaboration, and a branded client experience built for modern insurance firms.

Why insurance agency portals matter

Imagine a broker juggling dozens of policies, claims, and renewals. The inbox is full of client emails, document versions are scattered across systems, and every update requires a follow-up call. It is a daily reality for many insurance professionals.

This is where insurance agency portals make an impact. An insurance agency portal is a digital hub where clients and brokers can access policies, documents, and service interactions in one place. Instead of being a static folder, modern portals act more like a digital front desk that is open 24/7, secure, and always organized.

Clients benefit from self-service access, while agents gain efficiency by eliminating endless back-and-forth. For firms looking to stay competitive, the portal has shifted from “nice to have” to “must have”.

Power agent productivity – the hidden ROI of portals

The most powerful outcome of client portals is not just convenience for clients. It is the measurable impact on broker productivity.

Less time chasing information

Agents often spend hours each week finding policy details or tracking claim statuses. With a portal, all records are centralized, cutting out the manual chase.

Automating repetitive tasks

Tasks like sending reminders, requesting documents, or scheduling renewals can run automatically. This saves brokers from admin fatigue and lets them focus on advising clients.

Unlocking more revenue time

Studies show portals can boost agent productivity by over 40% while reducing cycle times for policies and claims. In practice, this translates into brokers spending more time selling and less time administering.

Take the example of a mid-size agency in Europe. Before launching a portal, its brokers spent nearly a quarter of their week on email follow-ups. Within six months of adopting a portal, the firm reported 30% faster claims processing and improved client satisfaction scores.

Core features of effective insurance agency portals

Not all portals deliver the same value. Some act as static repositories, while others provide a truly interactive client experience. The features below separate effective solutions from the rest.

Secure document and policy management

A well-designed portal should allow clients to upload, view, and manage policies or claims documents in a secure, centralized space. For brokers, this reduces compliance risks and prevents lost files. Platforms that offer bank-grade encryption, role-based file access, and built-in audit trails, like those seen in enterprise-grade portals, help maintain trust and regulatory readiness.

Real-time updates and self-service

Clients increasingly expect to submit forms, initiate claims, or request renewals without waiting on emails. A strong portal supports this with guided workflows and instant notifications, ensuring brokers are alerted to take action quickly. Some platforms go further with automated routing and real-time messaging, streamlining the back-and-forth for both sides and enhancing client satisfaction.

Seamless CRM and AMS integration

Effective portals don’t operate in isolation. The best solutions offer native integrations with CRMs and Agency Management Systems (AMS) to eliminate double data entry and create a unified view of client activity. When workflows sync across systems in real time, teams gain the operational efficiency of a centralized process without needing to rebuild their tech stack.

Compliance and security controls

With insurance workflows involving financial and personally identifiable data, portals must support end-to-end encryption, role-based access, and complete audit trails. Compliance with frameworks like SOC 2 and GDPR is now table stakes, particularly for firms in regulated markets. Portals designed for financial services often include these controls by default, making them a safer long-term investment.

Scalability and customization

As agencies grow and evolve, so do their client workflows. The right portal should offer white-label branding, custom workflow creation, and the flexibility to scale with business needs. Some platforms support embedded workflows and modular architecture, letting firms tailor the client experience without losing brand consistency or compromising usability.

What agencies are achieving with portals

Across the industry, forward-looking agencies are already demonstrating results.

- A UK-based broker implemented a self-service portal, cutting policy processing times by 40%. Clients could upload documents directly, and agents no longer wasted time chasing attachments.

- A US agency integrated its portal with its CRM. Brokers gained instant access to client history during calls, which increased cross-sell rates by 15 percent.

- Another mid-market insurer saw a dramatic drop in email clutter, with nearly 90% fewer back-and-forth threads after centralizing communication in a portal.

These examples highlight a consistent theme: productivity gains compound quickly when agents and clients operate in a shared digital hub.

Where Moxo fits in: Driving real broker productivity

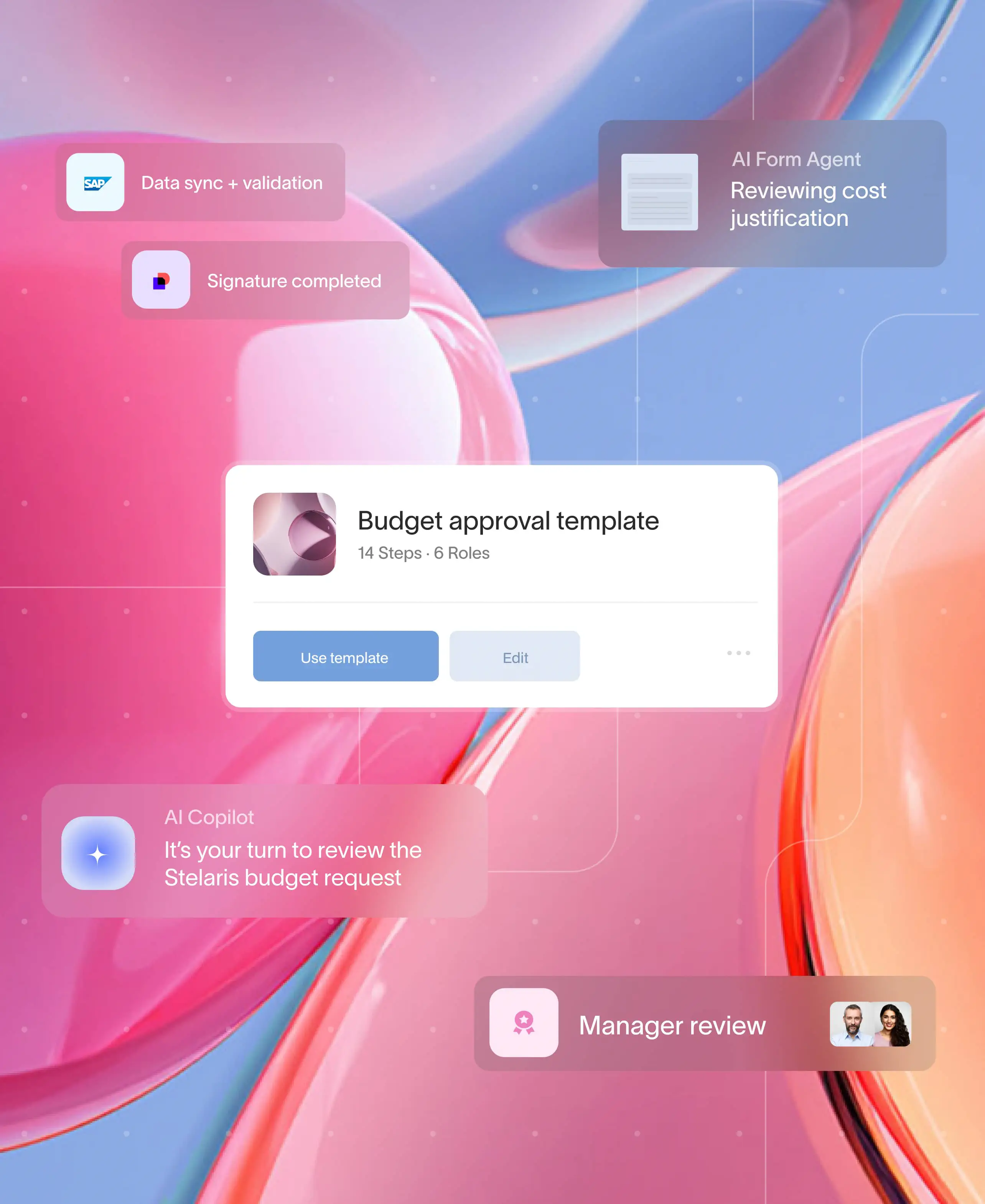

Moxo extends the idea of a client portal beyond static access. Designed for external workflows, it blends human actions, automation, and AI to keep processes moving. For brokers, this means less time coordinating and more time advising.

Here are four ways Moxo aligns with agency needs:

- Unified communication and file hub: Messaging, secure document sharing, e-signatures, and video calls all live within the branded client portal. No need to juggle inboxes, tools, or shared drives.

- Custom workflow automation: Brokers can automate intake forms, policy approvals, renewal reminders, and escalation rules—so manual follow-ups don’t slow down the client journey.

- Secure, branded experiences: Agencies create portals that reflect their logo, domain, and colors while operating with SOC 2 Type II and GDPR-compliant controls, including audit trails and role-based access.

- Seamless integrations: Moxo connects easily with CRMs, AMS platforms, and document systems—reducing duplicate entry and syncing workflows across internal and external teams.

Want to see how this works in practice? Explore how portals like Moxo streamline workflows and boost broker efficiency. Book a demo to experience a modern client portal in action.

Comparison: traditional vs modern insurance agency portals

This comparison shows why modern portals are evolving into strategic tools for productivity, not just digital filing cabinets.

Portals as productivity engines

Insurance agency portals are no longer about convenience. They are about competitiveness. By reducing admin work, cutting email clutter, and enabling real-time collaboration, portals give brokers back the most valuable resource of all: time.

As clients increasingly expect seamless digital experiences, agencies that adopt advanced portals will not only improve service but also sharpen their productivity edge.

Want to see how this works in practice? Explore how portals like Moxo streamline workflows and boost broker efficiency. Book a demo to experience a modern client portal in action.

FAQs

What is an insurance agency portal?

An insurance agency portal is a secure digital hub where clients and agents can manage policies, documents, renewals, and claims from one centralized platform. Solutions like Moxo offer a branded, mobile-ready experience that keeps everything organized and accessible.

How much productivity improvement can brokers expect?

Agencies using Moxo often report 30 to 40% gains in efficiency through faster policy cycles, automated follow-ups, and fewer manual tasks. It’s not just about speed. It’s about freeing up time for better client service.

Which features matter most in a portal?

The most effective portals offer secure document sharing, workflow automation, CRM and AMS integration, and compliance controls. Moxo delivers all of these in one seamless, client-facing platform.

Do portals integrate with existing systems?

Yes. Modern solutions like Moxo integrations connect with leading CRMs and AMS platforms, allowing data to flow smoothly across tools while keeping your workflows connected and secure.

Is implementation complex or costly?

Custom-built portals can be time-consuming and expensive. Moxo, as a cloud-based platform, offers faster rollout, lower implementation costs, and hands-on onboarding support to help teams get started with minimal disruption.