At a glance

The order-to-cash (O2C) process connects sales, fulfillment, invoicing, and collections across teams and systems.

Manual handoffs create delays, errors, and visibility gaps that slow revenue and increase costs.

Automation coordinates approvals, exceptions, and reporting while ERP and CRM systems manage transactions.

Moxo streamlines O2C workflows with integrations, dashboards, and templates that accelerate revenue recognition and ensure compliance.

Streamlining Order-to-Cash: The key to efficient revenue operations

Order to cash (O2C) is the backbone of revenue operations. It includes every step from receiving a customer order to collecting payment. Yet for many organizations, this process is fragmented. Sales works in the CRM, fulfillment teams rely on ERP, and finance manages invoicing and collections. Without automation, handoffs between these systems are slow and error-prone.

Research by PwC shows that companies with optimized O2C processes reduce days sales outstanding (DSO) by up to 20 percent, directly improving cash flow. The challenge is coordinating both system transactions and human approvals in a way that keeps data consistent and audit-ready. Moxo addresses this challenge by acting as the orchestration layer that bridges approvals, exceptions, and integrations across O2C stages.

O2C stages & handoffs

Order capture

Sales orders often begin in a CRM like Salesforce. Manual re-entry into ERP or finance systems introduces errors. Moxo ensures orders flow directly from CRM to the right validation and approval workflows.

Fulfillment

Once approved, orders move to ERP systems for fulfillment. Here, bottlenecks occur when teams lack visibility into approvals or stock levels. Moxo routes exceptions, such as out-of-stock products, to the right team without stalling the process.

Invoicing

Invoices are generated once fulfillment is complete. Errors at this stage delay cash collection and frustrate customers. Moxo validates invoice data before it is sent to clients, reducing disputes.

Collections

Collections require collaboration between finance and account managers. Automated reminders and escalations in Moxo ensure payments are followed up on systematically, while keeping a digital trail for compliance.

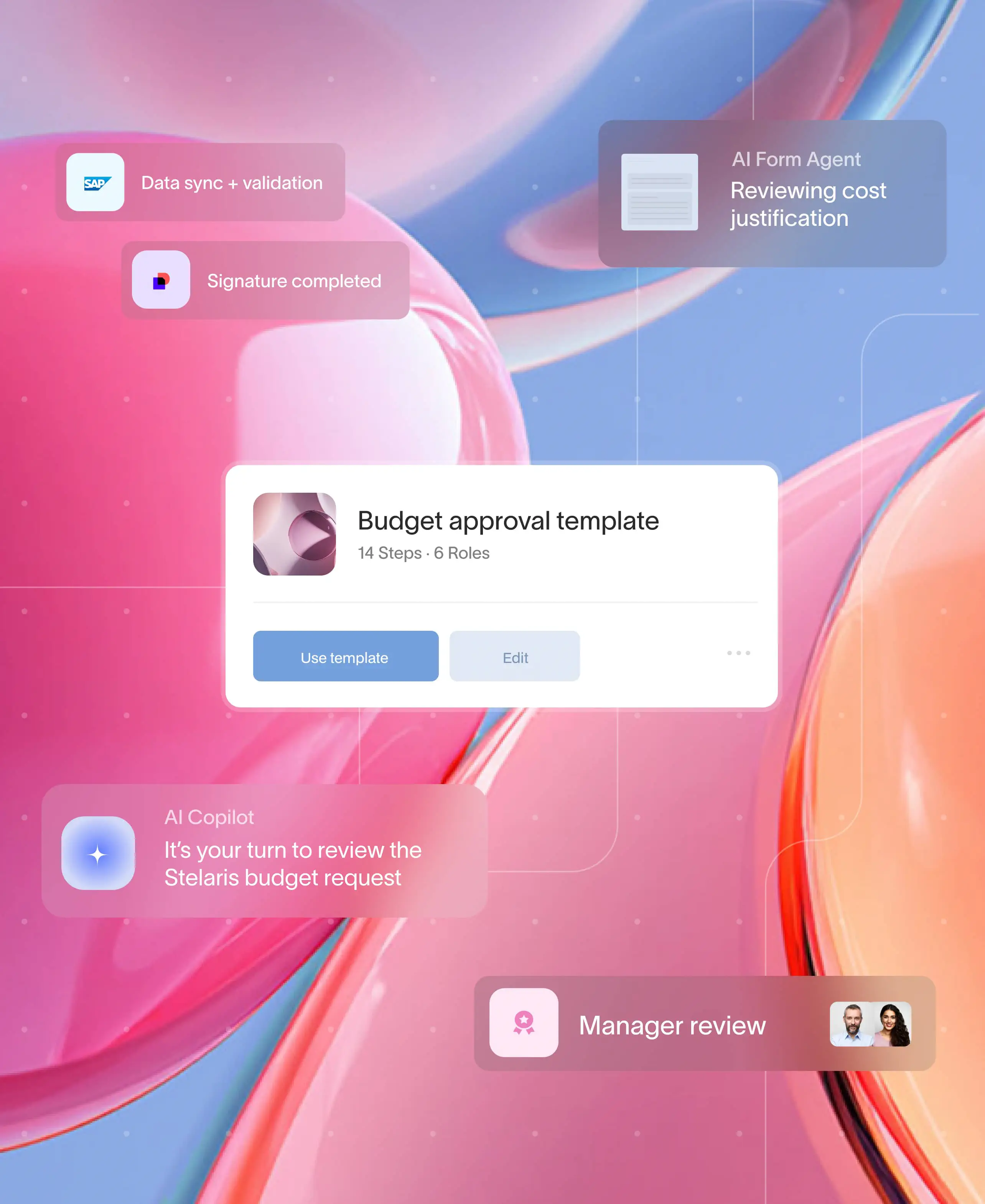

Orchestrating approvals & exceptions in Moxo

Approvals where they matter

Not every step requires human review, but critical points like high-value discounts, compliance checks, or contract deviations do. Moxo allows teams to configure approvals based on rules such as order size or risk rating. eSign makes approvals seamless while maintaining an audit trail.

Managing exceptions

Exceptions such as payment failures, compliance holds, or customer escalations often derail O2C cycles. Moxo uses AI Review Agents to flag anomalies and route them to designated reviewers. This human-in-the-loop oversight ensures that automation does not compromise compliance.

Escalations and SLA monitoring

If an approval or exception exceeds a defined SLA, Moxo automatically escalates it. For example, if an invoice dispute remains unresolved after 48 hours, it is routed to a manager for intervention. This prevents revenue leakage and strengthens accountability.

Integrations (ERP, CRM, payments)

Connecting the system landscape

The order-to-cash process is rarely handled in a single platform. Sales teams rely on CRM systems such as Salesforce, fulfillment operates in ERP platforms like SAP or NetSuite, and finance manages billing and collections through accounting or payment systems. When these tools are disconnected, teams waste valuable time reconciling records, chasing updates, and fixing errors. Moxo bridges these silos by acting as the orchestration layer that connects data and approvals across all systems, ensuring a seamless flow of information.

Standard integration patterns

- CRM to Moxo: Sales order data flows directly from CRM into Moxo, eliminating manual re-entry. This ensures that orders are captured with complete and accurate customer details right from the start.

- Moxo to ERP: Once validated and approved in Moxo, orders are automatically exported to ERP systems for fulfillment. This reduces lag time and ensures operations teams work with orders that are already reviewed.

- ERP to finance: Delivery and invoice data from ERP syncs back to finance systems. This keeps billing accurate and reduces disputes by aligning fulfillment records with what customers are invoiced for.

- Payment gateways: Moxo monitors payment status in connected gateways. If payments fail or stall, automated alerts and escalations are triggered, ensuring collections are addressed before revenue is at risk.

Why it matters

These integration patterns minimize manual effort, maintain data consistency across platforms, and provide a unified view of the order-to-cash lifecycle. Instead of chasing down status updates, teams gain visibility into the entire process within Moxo while still leveraging their existing CRM, ERP, and payment investments.

Example scenario

A B2B distributor receives a sales order in Salesforce. Moxo validates the order, routes it for approval, and pushes it into SAP for fulfillment. Once fulfilled, the invoice data syncs back to Moxo for validation and is sent to the client. If payment is delayed, Moxo triggers automated reminders and escalations.

KPIs & reporting

Why KPIs matter

Automation must deliver measurable improvements. Without clear metrics, leaders cannot track cycle times or prove ROI.

Moxo’s KPI dashboards

Moxo provides dashboards tracking:

- Order cycle time: The average duration from order intake to cash collection, showing where bottlenecks exist.

- Error rates: Validation metrics that reveal where inaccurate data enters the process.

- Approval turnaround times: Department-level insights into delays caused by slow reviews.

- Collections performance: Visibility into outstanding invoices and aging reports.

Continuous improvement

By monitoring these KPIs, leaders can identify where processes stall and adjust workflows accordingly. For example, if approval delays in finance consistently extend cycle times, Moxo’s dashboards provide the evidence needed to refine thresholds or allocate more resources.

Templates & checklists

Getting started quickly

Moxo provides pre-built templates for order-to-cash automation. These include configurable flows for order validation, fulfillment approvals, invoicing, and collections.

Customization for industries

Templates can be tailored for specific sectors. For example, financial services can add KYC checks, healthcare organizations can add HIPAA validation steps, and logistics companies can add SLA monitoring for deliveries.

Example quick-start

A SaaS company imports a standard O2C template, sets approval thresholds, connects Salesforce and NetSuite, and launches within weeks. This accelerates time-to-value and reduces reliance on IT resources.

Comparison table: Manual vs automated O2C

How Moxo helps

Moxo brings orchestration to the entire order-to-cash cycle by sitting on top of existing CRM, ERP, and finance systems. Instead of relying on manual re-entry or disconnected updates, Flow Builder enables organizations to design structured workflows that include validations, approvals, and escalations. For example, high-value discounts or compliance-sensitive orders can be routed for eSign-enabled approvals, while standard orders flow automatically. This ensures the right level of oversight without introducing unnecessary delays.

Beyond approvals, Moxo addresses the pain point of exceptions. AI Review Agents validate order data, detect anomalies, and trigger human review when confidence is low. Failed payments, compliance holds, or disputed invoices are flagged automatically and escalated based on SLA thresholds. With this blend of automation and human-in-the-loop oversight, businesses maintain speed while safeguarding compliance.

Coordinate approvals, exceptions, and reporting

The order-to-cash cycle is the lifeblood of revenue, but manual handoffs create unnecessary friction. By orchestrating approvals, managing exceptions, and connecting CRM, ERP, and payment systems, Moxo ensures that O2C workflows run smoothly. Dashboards provide the visibility needed to improve efficiency, reduce disputes, and accelerate collections.

If your organization is ready to eliminate O2C bottlenecks and accelerate cash flow, book a demo to see how Moxo can transform your order-to-cash workflows.

FAQs

How does Moxo fit with existing ERP and CRM systems?

Moxo integrates seamlessly with leading ERP and CRM platforms, acting as the orchestration layer rather than replacing core systems. This ensures continuity while adding automation and oversight.

Can Moxo handle exceptions like payment failures?

Yes. Exceptions such as failed payments, compliance holds, or escalated customer issues are flagged and routed to the right reviewer with full context for resolution.

How do organizations track ROI from O2C automation?

Moxo provides dashboards for cycle time, error rates, and collections performance. These metrics make it easy to calculate improvements in efficiency and working capital.

Is O2C automation suitable for regulated industries?

Yes. Moxo supports human-in-the-loop approvals, audit logs, and role-based permissions, making it compliant with standards like SOX, HIPAA, and GDPR.

How fast can companies deploy O2C workflows in Moxo?

With pre-built templates, organizations can launch workflows in weeks. Customization ensures alignment with industry-specific requirements and compliance standards.