At a glance

Claims adjudication drives fairness, compliance, and payout accuracy through connected rules, validations, and approvals in a unified workflow.

Customizable, audit-ready workflows provide clarity, control, and compliance across every stage of the claims process.

Automation combined with human oversight enhances decision consistency and reduces processing time.

End-to-end transparency and secure data governance strengthen accountability and build a trusted claims experience.

Claims adjudication is the critical bridge between reporting and payment

Every insurance claim carries a story, but not every story qualifies for payment. The process of determining which ones do is known as claims adjudication, the disciplined review of policies, data, and evidence to ensure decisions are accurate, fair, and compliant.

For insurers, this step defines both trust and efficiency. It prevents leakage, maintains compliance, and directly affects customer satisfaction. Yet for many, adjudication remains a fragmented process managed through emails and manual spreadsheets.

This guide explores the core rules, validations, and thresholds that shape adjudication and how orchestration through Moxo brings structure, visibility, and consistency to the process.

The scope of adjudication: verifying coverage, evidence, and payouts

Claims adjudication bridges intake and payment, verifying accuracy at every step. It ensures the claim meets coverage terms, includes complete evidence, and follows internal controls before payout.

Adjudication typically includes coverage verification, document validation, deductible calculation, and decision approval. Each stage must be transparent and traceable to build regulatory and client confidence.

Example: In an auto insurance claim, the adjuster confirms active coverage, reviews repair estimates, applies deductibles, and determines the approved payout. This structured process ensures fairness for both insurer and claimant.

Foundation layer: applying consistent rules and data validations

Rules form the foundation of adjudication. They enforce consistency, eliminate ambiguity, and reduce risk. Validations confirm that incoming data and documentation align with those rules.

Coverage validation

Coverage checks confirm eligibility, policy period, and claim type. In Moxo workflows, automation instantly cross-checks policy data, ensuring only valid claims advance for approval.

Financial limits and deductibles

Financial rules apply payout caps and deductibles automatically, reducing human error and manual calculations. This transparency builds trust with both regulators and clients.

Fraud detection and duplicate checks

Fraud prevention relies on data matching and behavior analysis. Within Moxo’s orchestrated environment, AI and automation can identify duplicate submissions or inconsistent records, flagging them for review before payment.

Data and documentation accuracy

Accurate documentation accelerates processing. With document collection embedded into the adjudication flow, teams capture forms, receipts, and signatures in one secure workspace for instant verification.

Human oversight layer: using thresholds and delegation for high-stakes claims

Even with strong automation, human oversight remains critical. Thresholds and delegation rules maintain quality while preventing bottlenecks.

Thresholds: High-value or high-risk claims automatically route to senior reviewers.

Delegation: Tasks reassign seamlessly when an adjuster is unavailable.

Escalations: SLA-based triggers notify reviewers before deadlines lapse.

A regional insurer implemented threshold-based routing in its Moxo workflow, cutting manual reassignments by 30 percent and improving turnaround time.

With digital governance, approvals move swiftly while maintaining oversight.

Handling exceptions flexibly while maintaining auditability

No rulebook captures every case. Exceptions ensure flexibility while retaining compliance.

For example, incomplete medical reports or conflicting invoices can trigger evidence requests using Magic Links. Claimants or vendors can securely upload files without needing logins.

All interaction requests, comments, and approvals remain traceable in the client portal, ensuring transparency for audits and regulators.

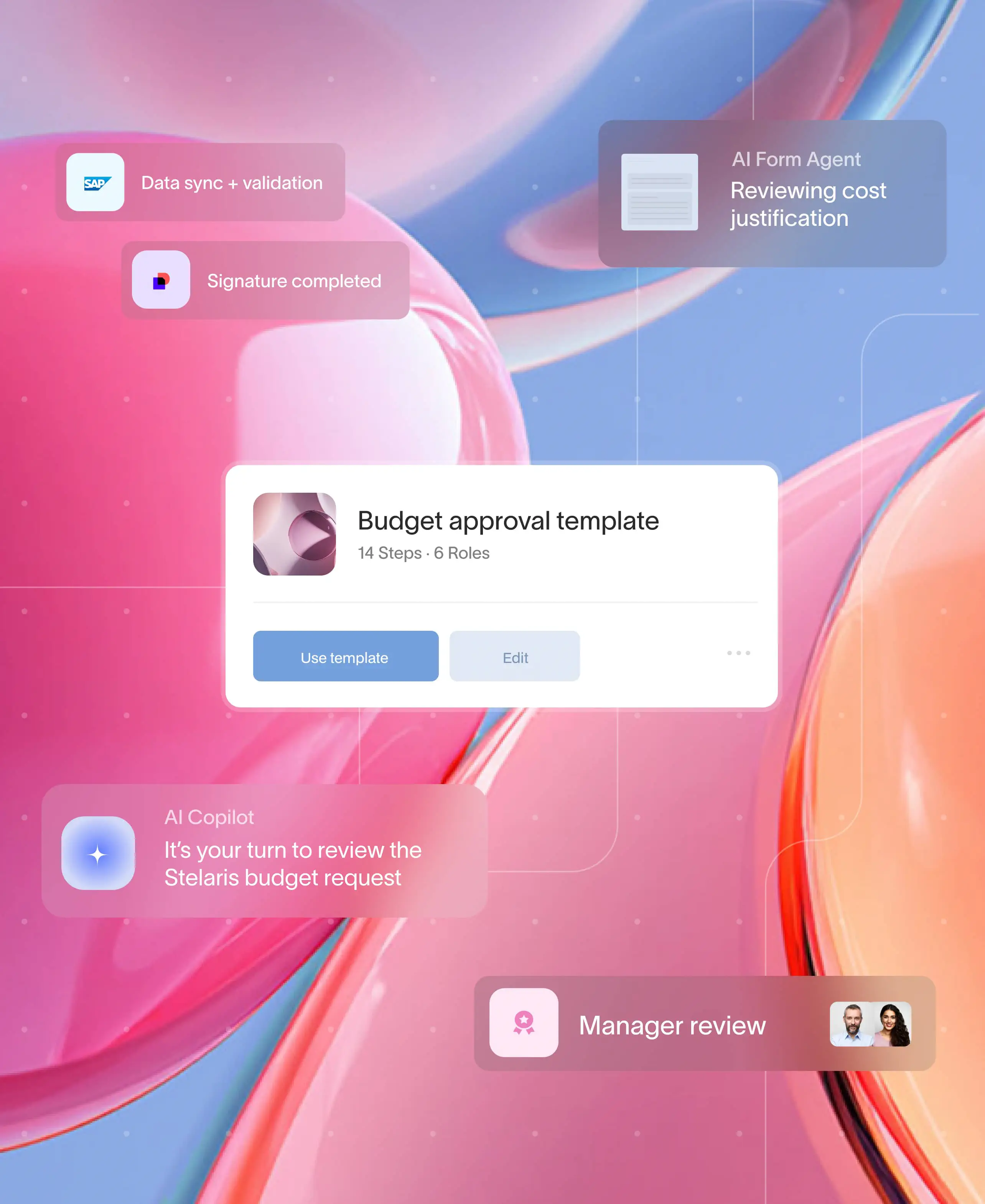

Build an orchestrated claims adjudication flow in Moxo

Digitizing adjudication requires both automation and orchestration. Here’s how insurers can build end-to-end adjudication flows in Moxo.

Flow builder

Design the adjudication process visually in Flow Builder from intake forms and file requests to final approvals without coding.

Controls

Set branches, thresholds, SLAs, and milestones to guide claim routing.

Example: “Claims under $5,000 close automatically; higher-value claims escalate for manual review.”

Automations & integrations

Moxo integrations connect the workflow to core systems, CRMs, or payment gateways. This ensures real-time synchronization of policy, finance, and adjudication data.

Magic Links for externals

External stakeholders such as brokers, vendors, or claimants can participate securely via Magic Links. Every submission or approval is logged for compliance.

Management reporting

Dashboards track metrics like cycle time, STP rate, leakage, and re-open rate. Managers can segment results by region or business line for targeted improvements.

Governance

Moxo’s security framework ensures SOC 2, GDPR, and HIPAA compliance with SSO, MFA, and continuous audit trails. A customer noted that Moxo “keeps approvals auditable, even across external collaborators.”

Traditional vs orchestrated adjudication

How Moxo helps

That’s where Moxo brings clarity to the complexity of claims adjudication. Its no-code workflow builder and automation tools help teams design, route, and manage claim reviews from one centralized hub.

Real-time updates, secure document collection, and Magic Links keep every stakeholder aligned and compliant. With enterprise-grade security and full audit trails, insurers gain transparency and control without adding operational complexity.

Organizations across insurance, financial services, and consulting use Moxo to reduce claim cycle times, minimize leakage, and ensure every decision remains data-backed and traceable.

Moving claims adjudication forward

Adjudication is where precision and accountability converge. It ensures each payout aligns with policy coverage, evidence, and compliance standards. By connecting rules, validations, and approvals within one digital workflow, insurers achieve consistency, clarity, and faster resolution.

With Moxo, insurers eliminate fragmented systems and deliver audit-ready transparency across every claim. Real-time collaboration and automated routing strengthen governance while improving efficiency.

Ready to simplify and modernize your claims adjudication process? Explore how Moxo helps insurers streamline operations and see the impact in action.

FAQs

What is claims adjudication in insurance?

Claims adjudication is the process of verifying, validating, and approving claims to ensure they meet coverage and policy rules. With Moxo, teams can digitize this entire workflow for consistency and compliance.

How do rules and validations improve adjudication accuracy?

Rules define eligibility, limits, and deductibles, while validations ensure data completeness. Moxo automates both, helping insurers minimize errors and ensure fairness.

How does automation support claims adjudication?

Automation enforces policy logic and accelerates approvals. With Moxo workflows, insurers can process claims faster without compromising oversight.

Can external vendors or policyholders submit documentation securely?

Yes. Using Magic Links, external users can upload files or respond to requests without login credentials while maintaining full audit visibility.

How does Moxo ensure regulatory compliance in adjudication?

Moxo follows SOC 2, GDPR, and HIPAA standards with encryption, access control, and continuous audit trails to protect sensitive claim data.