At a glance

Insurance firms are under pressure to digitize complex processes like claims, endorsements, and multi-party approvals.

Workflow automation software reduces leakage, accelerates settlements, and delivers compliance-ready documentation.

Selecting the right platform requires evaluating integration depth, user experience, and governance controls.

Moxo provides secure client portals and orchestration tools that streamline insurance workflows end to end.

Why workflow automation is reshaping insurance in 2025

The insurance industry is at a turning point. Manual workflows, siloed systems, and fragmented communication are still slowing down claims, underwriting, and policy servicing, even as customers expect real-time digital experiences.

In 2025, workflow automation isn’t a nice-to-have; it’s how insurers stay compliant, efficient, and competitive. Automation connects people, processes, and platforms, turning what used to take weeks into structured, auditable flows that move in hours.

This guide helps you understand the insurance automation landscape, what to look for in a solution, and how to choose software that aligns with your organization’s goals.

The urgency to modernize insurance workflows

Insurance leaders are operating in a landscape where policyholder expectations are rising rapidly. A recent Accenture study found that 87% of policyholders now expect digital-first experiences when filing a claim. Yet, most carriers remain tied to fragmented, manual processes that stretch claim cycles from days into weeks.

Take the First Notice of Loss (FNOL): a customer uploads accident photos, a broker requests extra details, and an adjuster seeks estimates. Each step is slowed by email back-and-forth, creating frustration for all parties. The result is higher leakage, missed SLAs, and declining Net Promoter Scores.

This is where insurance workflow automation software becomes critical. It orchestrates every stakeholder interaction, policyholders, brokers, vendors, while maintaining compliance and providing transparency across the value chain.

What is insurance workflow automation software

Insurance workflow automation software digitizes repetitive, rules-based processes that involve approvals, documentation, and coordination across multiple stakeholders.

Think of it as the connective fabric that unites your core systems, human approvals, and AI tools into one structured process.

Common examples include:

Claims automation: FNOL → validation → adjudication → payout

Underwriting automation: intake → enrichment → risk scoring → approval

Policy administration: endorsement → renewal → billing

Compliance: evidence tracking → reporting → audit readiness

Instead of managing tasks across spreadsheets and email chains, insurers can use a single workspace where every request, review, and decision is visible, auditable, and trackable.

Why it matters in 2025

Regulation is tightening, AI is maturing, and insurers are under pressure to do more with less. According to McKinsey, automation can reduce claims costs by up to 30%, while Gartner predicts that over 70% of insurers will deploy AI-driven workflow orchestration tools by 2026.

The benefits are clear:

- Faster turnaround times

- Lower operational costs

- Transparent audit trails

- Better customer experience

In short, automation has become the foundation for modern insurance operations — not just a back-office upgrade.

Why insurers struggle with workflows

Core insurance workflows—FNOL, endorsements, underwriting, and adjudication—span multiple teams and external parties. Two problem areas consistently emerge:

- Human-in-the-loop dependencies: underwriters, adjusters, or compliance officers must review files and approve steps. Without automated reminders and structured routing, bottlenecks form.

- Cross-boundary orchestration: insurers must coordinate with brokers, policyholders, providers, and external systems. Without secure portals, this leads to data re-entry, delays, and security risks.

The stakes are high. A McKinsey report estimates that automation can cut claims costs by 30% when insurers integrate end-to-end processes. Yet adoption falters because traditional project management or repository-style tools are not built for multi-party workflows.

Moxo client examples illustrate the shift. A regional carrier used Moxo’s secure portal to coordinate claims intake, enabling policyholders to submit photos, forms, and e-signatures in one place. The result was a 40% faster approval cycle and 75% increase in client capacity, with full compliance tracking.

Types of insurance automation platforms

The insurance technology landscape is vast, but not all automation tools are equal. Understanding where each fits helps you choose wisely.

- Core systems (Guidewire, Duck Creek): Handle transactions and record management but lack flexibility for complex human workflows or external collaboration.

- Point tools (OCR, fraud detection): Solve isolated problems like document processing or scoring but operate in silos — often creating new integration headaches.

- End-to-end orchestration platforms (like Moxo, Kissflow, Quentic): Connect every stage of the insurance process — human and system-based — in one auditable flow.

The sweet spot lies in orchestration — software that unifies every participant, system, and document under one connected workflow.

Core workflows where automation matters most

FNOL, endorsements, and adjudication

Automation reduces manual intake and accelerates adjudication. With portals, policyholders can upload documents, receive instant confirmations, and track progress. Moxo integrates this into a branded, mobile-first environment.

Gaps in human-in-the-loop steps

Approvals are inevitable, but delays are optional. Automated reminders, role-based access, and escalation workflows ensure no file stalls.

Patterns, pitfalls, and integrations

Common pitfalls include:

- Implementing internal-only tools that exclude policyholders and vendors.

- Over-engineering rules without considering customer experience.

- Ignoring integrations with claims core platforms, CRMs, and payment rails.

With Moxo’s integrations, insurers connect policy admin systems, DocuSign, Jumio, and payment providers to orchestrate the entire journey.

Common workflows insurance teams automate

Key features to look for in 2025

When evaluating insurance workflow automation software, prioritize these core capabilities:

End-to-end workflow automation: Manage every step — from FNOL to subrogation — in one connected flow.

AI-driven validation and document processing: Use intelligent agents to extract data, verify evidence, and reduce rework.

No-code flow builder: Empower business teams to design workflows without technical dependency.

SLA tracking and escalation logic: Automate deadlines, reminders, and approvals to prevent bottlenecks.

Compliance-ready audit trails: Maintain full transparency and accountability for every action.

External collaboration: Share documents and updates securely with clients, brokers, and vendors.

System integrations: Connect seamlessly with Guidewire, Duck Creek, and DocuSign.

Analytics and dashboards: Track KPIs, cycle times, and SLA adherence across business lines.

Decision checklist: What to look for in insurance workflow automation software

Evaluation criteria: How to choose the right software

Choosing an automation platform is about more than features — it’s about alignment. Evaluate based on these criteria:

- Integration: Does it work with your existing systems?

- Ease of use: Can non-technical teams build workflows quickly?

- Security: Is it SOC 2 and GDPR compliant?

- Scalability: Can it support high-volume, multi-region operations?

- Analytics: Does it offer visibility into ROI and process health?

- Vendor reliability: Is the partner proven in the insurance domain?

Tip: Pick software that delivers quick wins in 60–90 days, not just promises of long-term transformation.

Best practices for implementation

Start small: Choose one process (like FNOL or endorsements) to pilot before scaling.

Map before you automate: Define SOPs and approval logic first.

Involve all stakeholders: Claims, compliance, and IT must co-design workflows.

Track KPIs: Monitor SLA performance, leakage, and turnaround times.

Embed compliance: Build evidence capture and approvals directly into flows.

Benefits of insurance workflow automation

Faster cycle times: Up to 50% reduction in claim or policy turnaround.

Fewer errors: Standardized templates and rules-based routing improve accuracy.

Better collaboration: Real-time visibility for all stakeholders.

Stronger compliance: Every step logged, versioned, and traceable.

Improved ROI: Reduced overhead and higher employee productivity.

Build it in Moxo: step by step

Moxo enables insurers to digitize every step of the claims lifecycle — from FNOL to settlement, through secure, no-code workflow automation. It bridges internal teams, external partners, and policyholders in one connected system that delivers speed, visibility, and compliance.

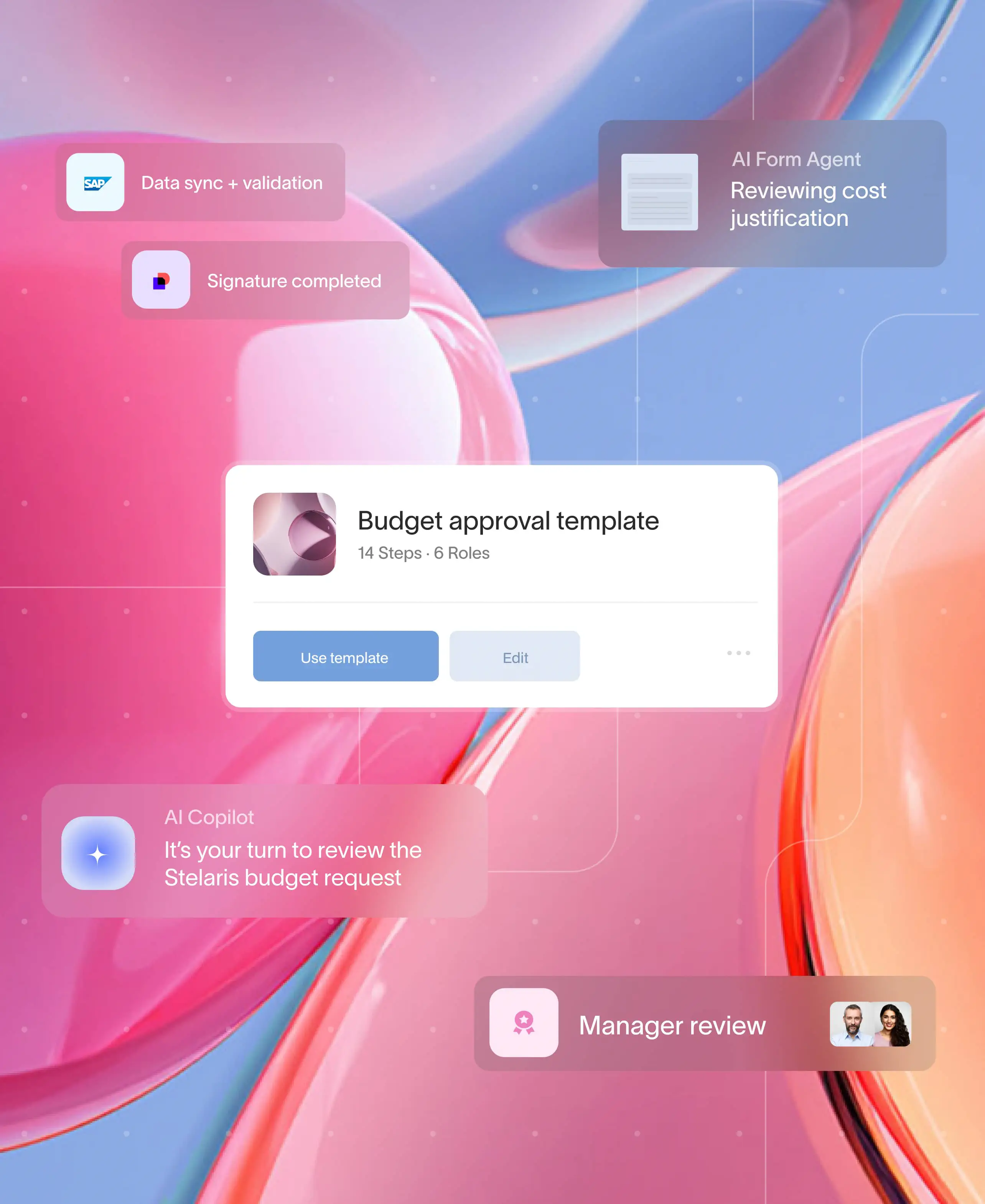

Flow builder

Use Moxo’s no-code Flow Builder to create forms, collect documents, trigger e-signatures, and automate approvals — all in one secure flow. Built-in controls let you branch workflows with decision points, milestones, thresholds, and SLAs to ensure compliance and timely execution.

Automations and integrations

Connect to core policy admin systems, CRMs, and payment platforms, or tools like DocuSign and Jumio, to eliminate manual re-entry and speed disbursements.

Magic links for external participants

Invite policyholders, brokers, or providers through magic links that allow one-click access without full platform accounts. Teams can collaborate through secure messaging, file sharing, and real-time updates inside a branded client portal.

Management reporting

Access performance dashboards to monitor cycle times, straight-through processing rates, leakage, and subrogation recovery. Filter results by region, channel, or product line.

Governance

Moxo ensures enterprise-grade security with SOC 2, GDPR, HIPAA, and SSO/SAML compliance, supported by audit-ready logs and exportable evidence for regulators.

Why Moxo fits best

Unlike internal workflow tools, Moxo is built for external orchestration where multiple parties, complex data, and compliance demands intersect. Insurers can accelerate FNOL, endorsements, and adjudication through:

Secure, branded client-facing portals with mobile-first access and dashboards

No-code workflow automation that teams can modify without IT involvement

Enterprise-grade security with encryption, GDPR readiness, and audit trails

Proven ROI: 40–60% faster approvals, 95% less email, and 75% more client capacity

Moxo gives insurers a single hub to orchestrate claims, connect stakeholders, and maintain compliance while reducing manual effort and elevating customer trust.

The ideal solution

The insurance sector is at a tipping point. Policyholders demand transparency, regulators require accountability, and margins are under pressure. Insurance workflow automation software enables insurers to orchestrate complex, external-facing processes securely.

Solutions that only handle internal tasks or act as static repositories fall short. Moxo’s secure portals, workflow automation, and reporting dashboards give insurers the confidence to modernize while meeting compliance needs.

If you’re exploring how to close workflow gaps and improve ROI, now is the time to act. Book a demo with Moxo.

FAQs

What does insurance workflow automation software do?

It automates and orchestrates policyholder, broker, and vendor steps in FNOL, endorsements, and claims. With Moxo, these workflows run securely in one portal.

How does workflow automation improve ROI for insurers?

Automation reduces cycle times by up to 60% and leakage by up to 30%. Moxo clients also report a 95% reduction in email reliance.

How does Moxo compare to tools like Kissflow or Asana?

Kissflow and Asana are internal task tools. Moxo adds external orchestration, secure portals, compliance controls, and integrations insurers require.

Is insurance workflow automation software secure?

Yes, leading platforms provide SOC 2 compliance, encryption, and audit trails. Moxo adds HIPAA/PHI handling and role-based access.

How much does Moxo cost?

Pricing depends on scale and features. See Moxo pricing for details.