At a glance

OCR invoice processing helps businesses digitize paper invoices, but it often struggles with accuracy and contextual understanding.

IDP, or intelligent document processing, builds on OCR by adding AI validation to improve consistency and reduce manual corrections.

LLMs, or large language models, bring reasoning capabilities that can detect anomalies or contextual cues, but still need structured guardrails.

Human oversight remains critical for accuracy, compliance, and trust—especially when exceptions or audit trails are involved.

By combining automation with human-in-the-loop workflows, Moxo enables faster, more secure, and auditable invoice processing at scale.

The evolution of invoice data capture

For most finance teams, invoice processing is still one of the most repetitive and error-prone back-office tasks. Manual entry delays approvals, inflates costs, and introduces compliance risks.

As reported by McKinsey, automation can reduce processing costs by up to 60 percent. The key is ensuring that the data entering the system is accurate and validated.

That’s where OCR, IDP, and LLM-driven tools come in—each offering a different level of sophistication in extracting, validating, and routing invoice data.

Understanding OCR, IDP, and LLMs

OCR: reading but not reasoning

Optical character recognition (OCR) software reads text from scanned invoices or PDFs and converts it into digital data. While it automates data entry, OCR struggles when layouts vary or when scanned images are unclear.

An invoice with a new vendor format or a handwritten note can confuse the system, forcing teams to review and correct the output manually.

IDP: learning from patterns

Intelligent document processing (IDP) adds artificial intelligence on top of OCR. It doesn’t just read text—it learns to classify invoices, detect key fields, and validate totals against past data.

For instance, if a vendor frequently uses a specific layout, IDP can recognize and process it more accurately over time. The system continuously improves through machine learning, reducing the need for repetitive corrections.

LLMs: adding reasoning

Large language models (LLMs) take a step further. They understand context—detecting if an invoice item or charge seems unusual compared to past behavior.

For example, an LLM might flag an invoice for 1,000 units when previous orders were consistently around 100. This ability to reason makes LLMs powerful, but they still need boundaries and human verification to ensure accuracy.

Accuracy, confidence, and exception handling

No system is flawless. Even advanced models encounter exceptions such as handwritten invoices, currency mismatches, or duplicate submissions.

The difference lies in how each system manages these edge cases:

- OCR simply extracts text, leaving staff to fill in blanks or fix errors.

- IDP flags inconsistencies and routes them for review.

- LLMs can suggest probable fixes but still need verification.

Most financial risk stems from these exceptions. Without visibility or an audit trail, duplicate or misclassified invoices can easily slip through. That’s why automation must include accountability features like audit logs, escalation paths, and secure user permissions.

Human-in-the-loop with Moxo

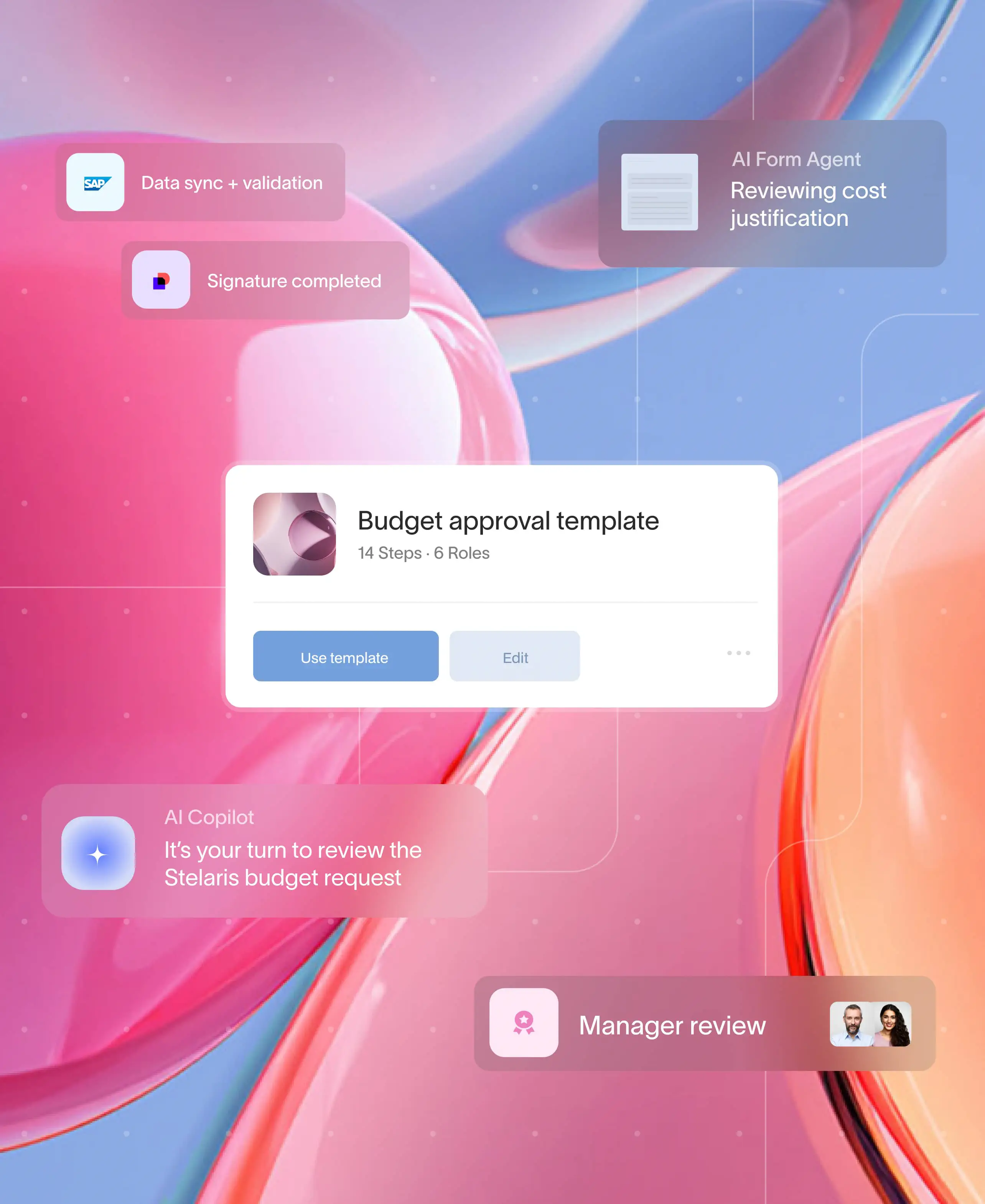

Moxo approaches automation differently—it combines the intelligence of automation with the judgment of humans. Exceptions are automatically routed to the right approver, with full context and version history intact.

Core elements that make this possible include:

- Secure client-facing portals that centralize invoice submission and tracking through the client portal.

- Role-based approvals that ensure the right person validates exceptions.

- Complete audit trails and compliance logs for every decision made.

- AI agents and real-time notifications that prevent delays in handling.

A good example is Shields Tax CPA, which used Moxo’s accounting workflow solution to cut invoice turnaround times by more than 50 percent. Clients uploaded invoices through a branded portal, and Moxo routed exceptions directly to approvers without email back-and-forth.

Connecting automation to ERP and AP systems

OCR and IDP tools often stop short at data capture, requiring manual work to transfer information into accounting systems.

Moxo integrations solve this gap by connecting invoice workflows directly to ERP and AP platforms like QuickBooks or SAP.

This allows:

- Clean, validated invoice data to flow seamlessly into accounting systems.

- Exceptions to remain visible until resolved, reducing ledger errors.

- Finance leaders to access dashboards tracking cycle times, bottlenecks, and compliance metrics.

By bridging capture and reconciliation, Moxo gives organizations both speed and control.

A ready-to-use template for ocr invoice processing

To make adoption easier, Moxo offers a starter template that combines automation with human review. It includes:

- OCR extraction for digitizing invoices.

- AI-based validation similar to IDP.

- Exception routing through Moxo’s no-code workflow builder.

- ERP/AP export with full audit trails.

This lets teams implement OCR invoice processing without the complexity of custom development or untested AI.

How Moxo helps

Optical Character Recognition (OCR) extracts data. Intelligent Document Processing (IDP) understands it. Moxo goes a step further—it connects document intelligence with workflow execution, enabling teams to act on invoice data instantly and securely within one unified system.

Intelligent data capture within workflows

Using document collection workflows, invoices are uploaded directly into Moxo, where AI-powered data extraction identifies key fields like vendor name, PO number, and amount. The workflow builder automatically routes them for validation or approval—reducing manual sorting and indexing.

Context-driven automation

Moxo’s workflow automation links extracted data to business logic. For instance, invoices above a certain threshold can auto-route to finance leadership, while verified vendor invoices go straight to payment processing. This combination of document intelligence and rule-based routing ensures zero delay between “read” and “act.”

Collaboration and audit readiness

Unlike standalone IDP tools, Moxo embeds document processing within secure, branded portals where vendors, approvers, and finance teams collaborate in real time. Each action—from file upload to approval—is tracked in audit-ready logs, ensuring accuracy and accountability.

Seamless system integrations

Moxo connects directly with ERPs, CRMs, and payment platforms, syncing extracted invoice data automatically. The result: faster processing, fewer touchpoints, and reliable reconciliation without duplicate entry.

Security and compliance at the core

With SOC 2, GDPR, and encryption-level security, Moxo ensures every invoice, document, and data field is handled with full regulatory compliance—essential for finance and audit teams managing sensitive vendor data.

By combining document intelligence with automation, Moxo transforms invoice processing from data extraction to actionable workflow orchestration—bridging the gap between OCR, IDP, and full-scale financial process management.

Comparing OCR, IDP, and Moxo

The smarter path forward

OCR, IDP, and LLMs each move invoice automation forward, but no single approach solves every challenge. Exceptions, compliance, and human judgment will always be critical.

Moxo bridges that gap by blending automation and human oversight within secure, auditable workflows. The result: faster invoice processing, fewer errors, and total transparency.

Automation should not replace human judgment; it should empower it. With Moxo’s secure, automated workflows, finance teams can achieve both efficiency and accountability without sacrificing control.

To see this in action, explore Moxo workflows or book a demo to learn how your finance team can modernize invoice handling with human-in-the-loop precision.

FAQs

What is OCR invoice processing?

OCR invoice processing uses optical character recognition to convert scanned or digital invoices into editable, machine-readable data.

How does IDP improve on OCR?

IDP adds artificial intelligence to classify, validate, and extract data more accurately, learning from patterns over time.

What role do LLMs play in invoice automation?

LLMs introduce reasoning—they understand context, identify anomalies, and enhance validation, but still need human oversight.

Why are exceptions a concern in invoice processing?

Exceptions, like inconsistent totals or duplicate invoices, can create financial risk. They require human review and a clear audit trail.

How does Moxo simplify invoice workflows?

Moxo automates invoice capture, routes exceptions, maintains compliance records, and integrates directly with ERP and AP systems for complete visibility.